Since the Corporate Transparency Act was signed into law in 2021, we’ve reported on how FinCEN, or the Financial Crimes Enforcement Network, has been building out expected reporting requirements. Final guidelines were published in September of 2022, and this month, the network has released its “Small Entity Compliance Guide,” designed to “help small entities comply with the requirements of the Beneficial Ownership Information Reporting Rule.”

The full guide is available here. Below are answers to some of the most frequently asked questions related to the reporting rules.

Is anything in the “Small Entity Compliance Guide” different from the final guidelines published last year?

Materially, no. The final guidelines published in September of 2022 are reflected in the “Small Entity Compliance Guide” that FinCEN recently released. From our perspective, the guide is designed for easier consumption compared to the final guidelines.

What is a beneficial owner?

Beneficial Owners are individuals who either 1) exercise substantial control over a Reporting Company or 2) own or control at least 25 percent of the ownership interest of a Reporting Company. It is notable that “substantial control” is defined broadly while the definition of “ownership” offers some exclusions (such as for minors and intermediaries).

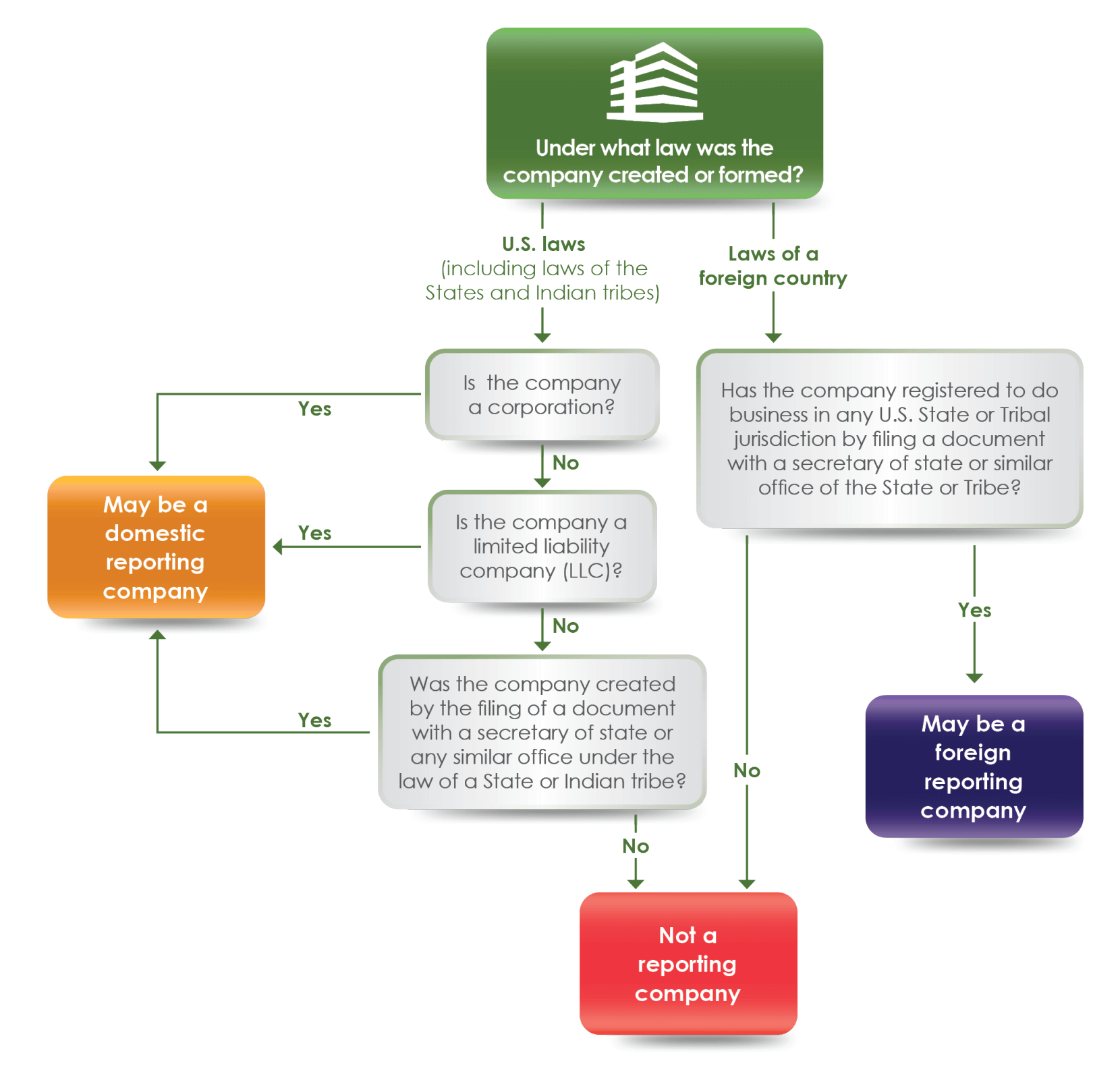

What types of companies must report?

The final rule expresses that domestic reporting companies and foreign reporting companies must file beneficial ownership information, or BOI, reports. A domestic reporting company is a corporation, LLC, or other entity created by filing documents with a secretary of state. A foreign reporting company is an entity created under the laws of another country but registered to do business in the United States as a result of documents filed with a secretary of state or comparable office.

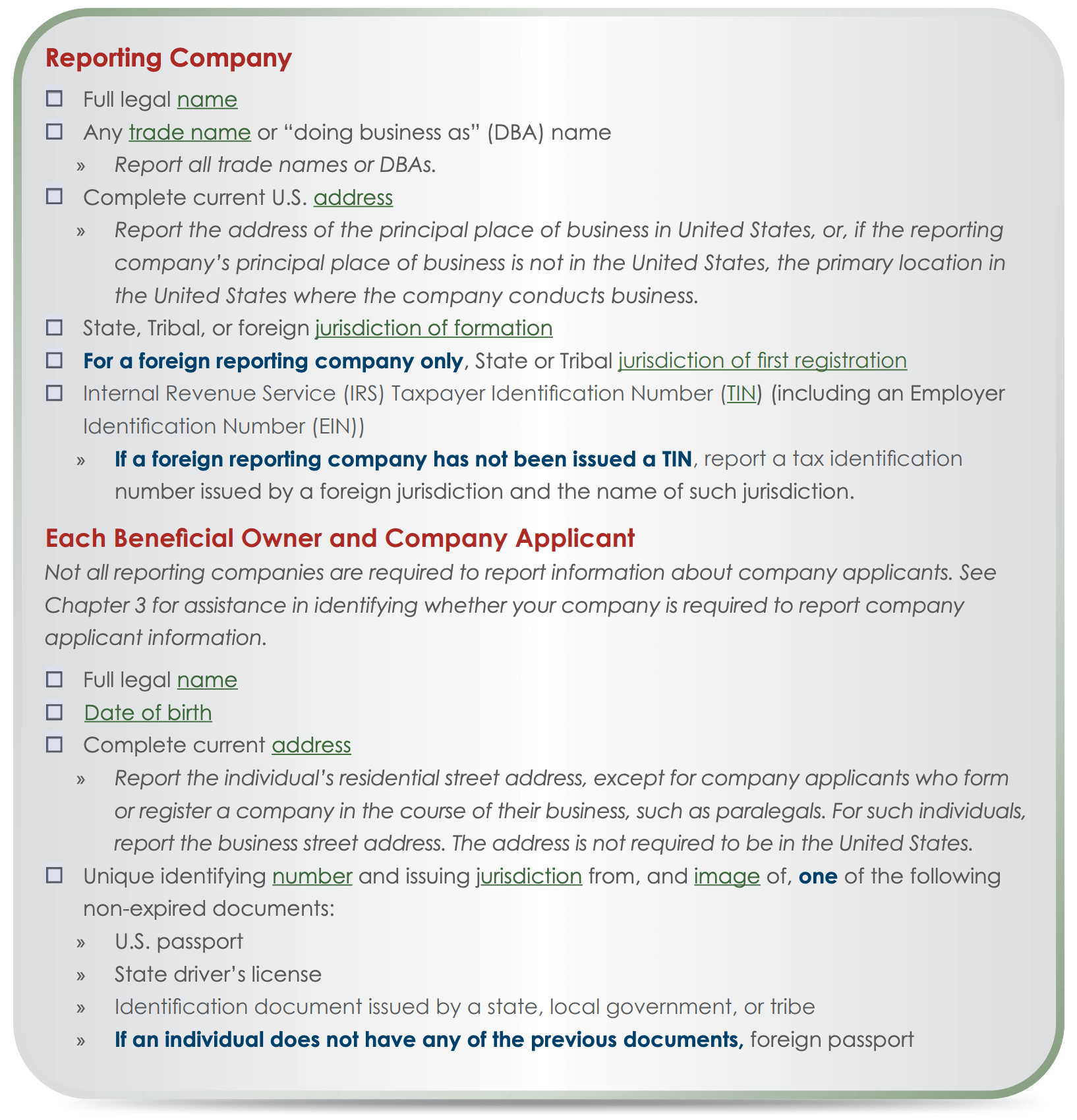

What information must reporting companies submit?

At a high level, reporting companies must submit information about the entity, information about the beneficial owner and information about the person(s) forming the entity, of which there may be up to two: the individual directing that the entity should be formed and the individual physically performing the filing.

Are any company types exempt from the reporting requirements?

Yes. There are 23 specific types of entities that are exempt from the reporting requirements:

- Securities reporting issuers

- Governmental authorities

- Banks

- Credit unions

- Depository institution holding companies

- Money services businesses

- Brokers or dealers in securities

- Securities exchange or clearing agencies

- Other Exchange Act registered entities

- Investment company or investment advisers

- Venture capital fund advisers

- Insurance companies

- State-licensed insurance producers

- Commodity Exchange Act registered entities

- Accounting firms

- Public utilities

- Financial market utilities

- Pooled investment vehicles

- Tax-exempt entities

- Entity assisting a tax-exempt entities

- Large operating companies

- Subsidiaries of certain exempt entities

- Inactive entities

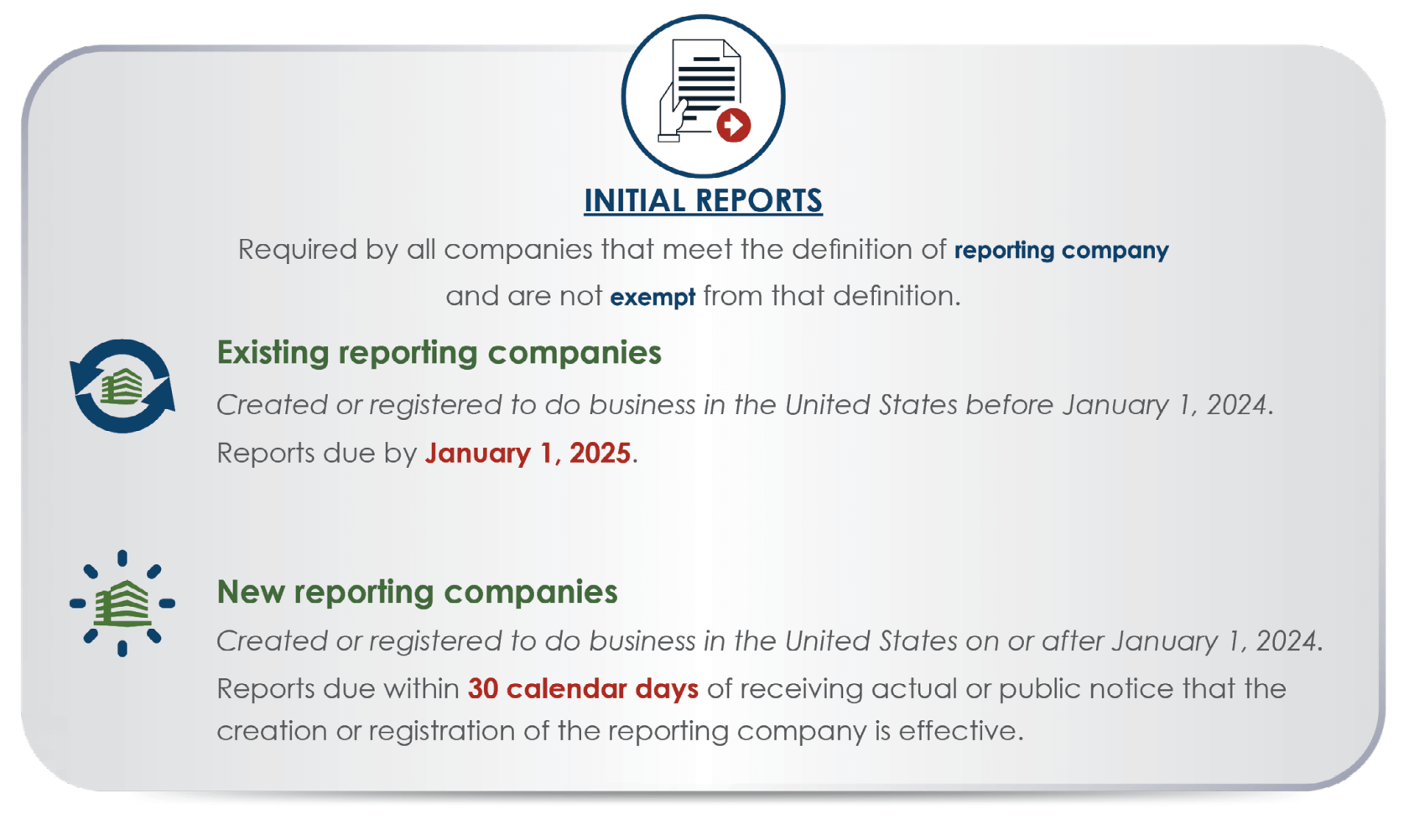

When should a reporting entity file?

According to the Small Entity Compliance Guide, “If a company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025. If a company is created or registered to do business in the United States after January 1, 2024, then it must file its initial BOI report within 30 days after receiving actual or public notice that its creation or registration is effective. However, there is pending legislation to allow entities 90 days to file their BOI report.

Are there any ongoing requirements?

Yes, but only in the case of a change in Beneficial Owner information. There is no annual filing requirement, so it is important that the Reporting Company remembers to update its BOI Filing should any of the information change.

Are there penalties for failure to report?

Indeed, there are. The Small Entity Compliance Guide state that “the willful failure to report complete or updated beneficial ownership information to FinCEN, or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.”

Can Incserv help with beneficial ownership filings?

Absolutely! Contact us at info@incserv.com or call 800-346-4646.

All images sourced from the Small Entity Compliance Guide, FinCEN